how to open tax file malaysia

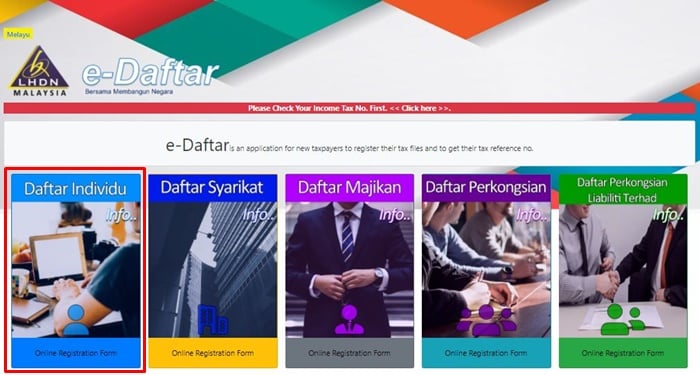

An application via internet for the registration of income tax file for individuals companies. First is to determine if you are eligible as a taxpayer 2.

Guide To Using Lhdn E Filing To File Your Income Tax

Click on the borang pendaftaran online link.

. Alternatively you can either check online via e-Daftar or give LHDN a call at 03-89133800. Login to e-filing website. Before signing you can click cetak draf to download and save your file.

Register Online Through e-Daftar. Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are required to register and furnish Form E with effect from Year of Assessment 2014. Go to e-Filing website.

Verify your PCBMTD amount 5. How To File Income Tax In Malaysia In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing. They need to apply for registration of a tax file.

Click on e-Filing PIN Number Application on the left and then click on. File your income tax online via e-Filing 4. Click on the e-Daftar icon or link.

Here is the step-by-step guide for the e-Filing process. You must be wondering how to start filing income tax for the. The answer is pretty simple particularly if youre a salaried employee receiving the entirety of your income from your employers.

When you arrive at IRBs official website look for ezHASIL and click on it. To register or log in to your e-Filing for the first time youll need a PIN provided by the LHDN. Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax.

Go back to the previous page and click on Next. Maximising your tax relief and rebates to get your money back 6. Sila klik ya untuk teruskan atau klik tidak dan lakukan log masuk kali pertama atau semak semula no.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. How to open tax file malaysia. Resident individuals who do not carry on a business will file the BE form whereas resident individuals who do carry on a business will file the B form.

Filing income tax as a foreigner. In the textbox labeled Enter your User ID type in. Ibu Pejabat Lembaga Hasil Dalam.

Use e-Daftar and register as a taxpayer online. Fill in your income details. A business or company which has employees and fulfilling the criteria of registering employer tax.

Click on e-Daftar. Taxpayers are advised to submit their. Click on ezHASiL.

You can file your taxes on ezhasil on the lhdn website. Login to e-Filing website. All tax residents subject to taxation need to file a tax return before April 30th the following year.

How To File Your Income Tax Manually In Malaysia. Download a copy of the form and fill in your details. Click on Permohonan or Application depending on your chosen language.

After registering LHDN will email you with your income tax number within 3 working days. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Where a company commenced operations.

Go through the instructions carefully. Visit the official Inland Revenue Board of Malaysia website. Fill in your tax reliefs tax rebates and tax exemptions.

Those earning around RM3000 per month and above would qualify here. If you do not hold but require an Income Tax Number you should. Ensure you have your latest EA form with you 3.

In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal. According to the LHDN individuals in Malaysia earning a minimum of RM34000 after EPF deductions must register a tax file. Choose the right income tax form.

This will lead you to the main page of the the e-filing system. Online submissions of tax returns for 2021 will be accepted beginning March 1 the Inland Revenue Board LHDN said today. Check your personal details.

Access the official Income Tax Department Portal by going to the URL httpswwwincometax govin and clicking on the Login Here link on the homepage of the website. Scroll down until you see Muat Naik Disini where youll need to upload a copy of your Identity Card. How to Register a tax file in Malaysia.

Go through the instructions carefully. You can either visit the LHDN Customer Feedback website and. Taxpayers are advised to submit their.

Register for first-time taxpayer online via LHDN MalaysiaA. At the various options available on the ezHASIL page choose myTax. To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process onlineYoull need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand.

Go to e-filing website.

How To File Income Tax In Malaysia 2022 Lhdn Youtube

Income Tax Number Registration Steps L Co

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

How To File Your Taxes For The First Time

Guest Information Folders Hotel Visitor Room Folders

Introduction To Fxfactory User Manual Pinterest Final Cut Pro

How To File Your Taxes For The First Time

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Introduction To Fxfactory User Manual Pinterest Final Cut Pro

7 Tips To File Malaysian Income Tax For Beginners

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

New Restaurant Cash Handling Policy Template

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CRFFS4E5UVITJDU2QDNLPEXHKA.jpg)

Singapore Malaysia To Open Land Border For Vaccinated Travelers Reuters